eurasia-epc

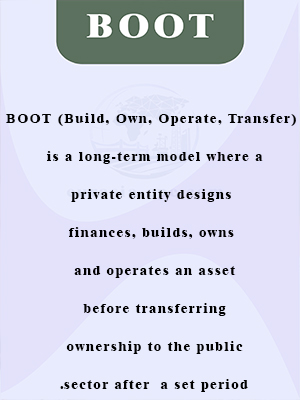

Common and localized models in the Eurasian region

Overview of investment models and legal structures designed to guide investors and project owners in planning and executing projects efficiently. ,

eurasia-epc

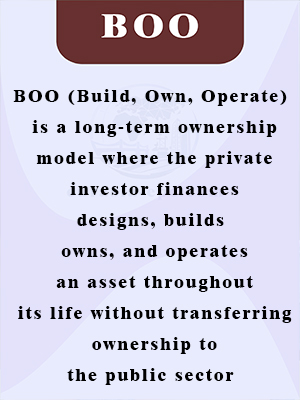

Contractual and project implementation models

Exploring different contract and execution models to connect project owners with the most suitable delivery and collaboration approaches. ,

eurasia-epc

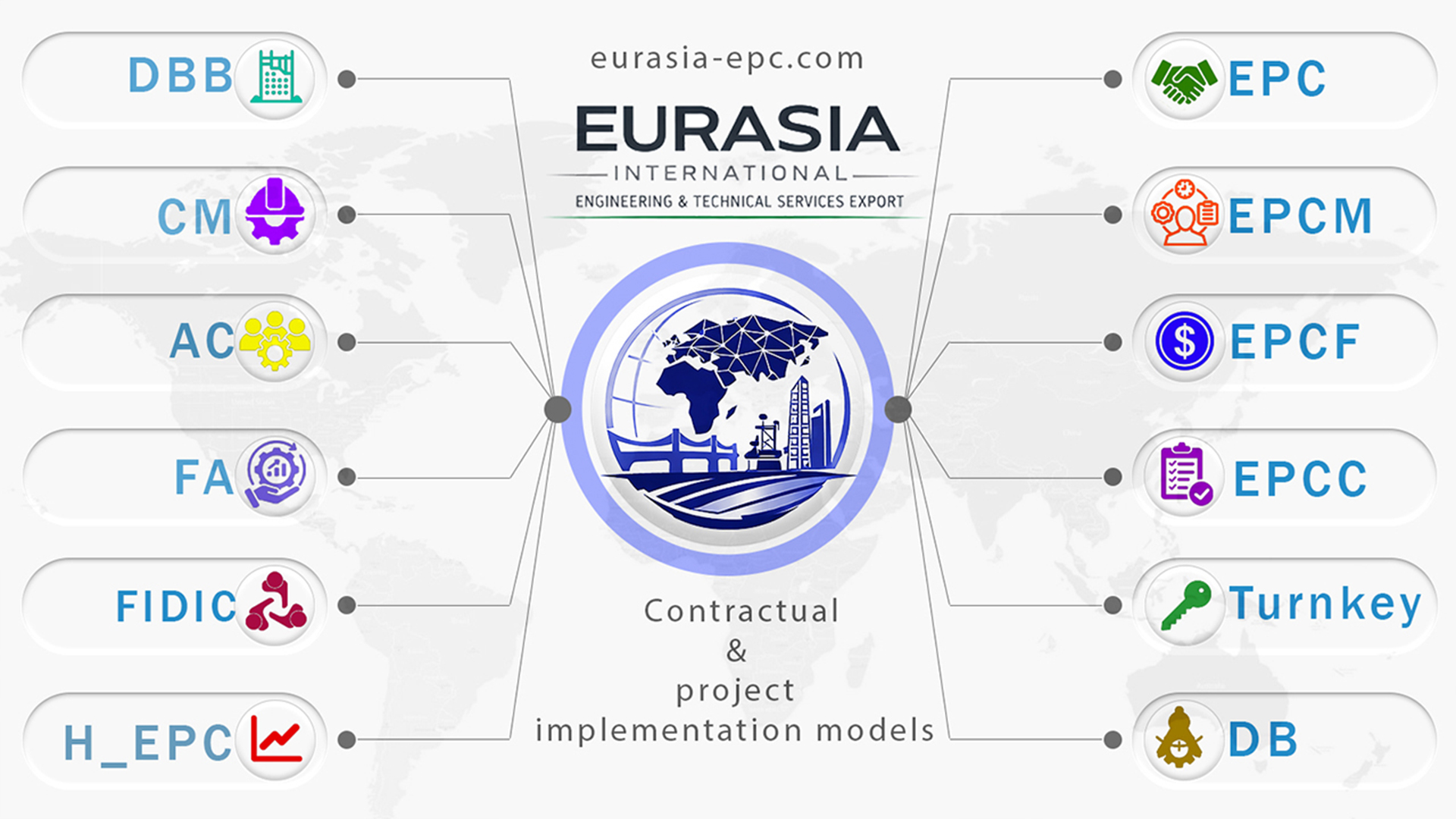

Investment models and legal structure

Showcasing various projects and investment opportunities using equity and partnership models tailored to the needs of investors and project owners. ,

eurasia-epc

Project Financing Models

Project financing based on various financial models, designed to showcase suitable investment opportunities for investors and projects. ,